Daily Market Comment – Dollar and stocks struggle amid anxious calm before the storm

- Tech earnings and US data awaited for direction as outlook remains clouded

- Lingering uncertainties drag US yields and the dollar lower; debt ceiling in focus

- Yen firms slightly after Ueda opens the door to future policy tightening

Markets turn tense in wait-and-see mode

Markets turn tense in wait-and-see modeStocks slid on Tuesday while the US dollar crawled above fresh lows as investor anxiety was running high following a tense session on Monday amid a number of uncertainties weighing on the markets. Investors remain none the wiser about the likelihood of a US recession even as the most recent PMI indicators pointed to ongoing resilience. The renewed jitters about a possible downturn in America and elsewhere came about after bailed-out First Republic Bank posted a bigger-than-expected outflow of deposits, spooking the markets.

Wall Street’s major lenders may have emerged unscathed from the banking stress but this earnings season is also laying bare the full scale of the damage incurred by their smaller regional rivals. Whilst that doesn’t mean that other banks are about to collapse, investors are being reminded that the spillover effect is probably not over and that credit conditions may continue to tighten for months to come.

Debt ceiling standoff adds to mounting headachesWith the week getting off to such a slow start, traders are starting to feel the heat from all the existing uncertainties that are no closer to being resolved. Aside from the banking troubles in the US, concerns about sticky inflation and what that means for the monetary policy outlook have also been on investors’ minds, not to mention doubts about the strength of China’s recovery.

If that wasn’t enough, the US debt ceiling is back in the headlines as the White House and the Republican-controlled House of Representatives are in a predictable standoff over raising the borrowing limit. House Speaker Kevin McCarthy is pushing for a vote this week on a bill that would slash spending by $4.5 trillion but increase the debt ceiling by just $1.5 trillion.

The Senate, where the Democrats have a majority, is unlikely to approve such a plan and fears of a debt default are rising as the US government could run out of cash as early as June due to lower-than-expected tax revenues.

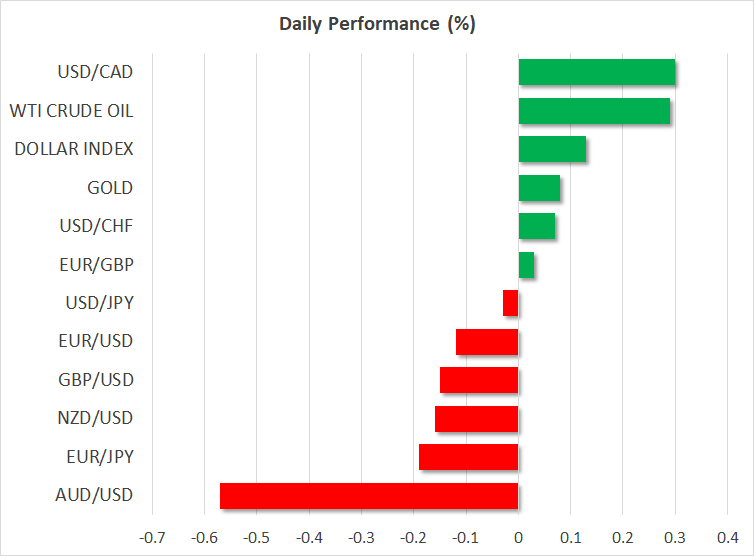

Dollar off lows as euro stumbles, yen mixedFed fund futures responded to the heightened nerves by pricing in somewhat higher odds of a rate cut by December, though for the May FOMC meeting next week, a 25-bps hike is a near certainty. Bond markets also attracted attention as traders sought safety in the midst of all the worries, pushing yields lower.

The 10-year Treasury yield just hit a 10-day low of 3.4430% and the two-year yield was down too. But the US dollar managed to find some footing to climb off its earlier session lows against a basket of currencies. US GDP and PCE inflation data due later in the week might inject some life into the greenback. In the meantime, the April consumer confidence index will be watched today.

The euro was holding above the $1.10 level after yesterday’s impressive rise. However, it may struggle to advance much further before the ECB meeting on May 4 as there’s some mixed messages again coming from policymakers. While some officials like Schnabel are sounding extremely hawkish, others such as France’s Villeroy see the tightening cycle coming to an end soon.

The yen was flat against the dollar on Tuesday and has been stuck around the 134 level since Friday. Newly appointed Bank of Japan governor Kazuo Ueda maintained the need for ultra-easy policy when speaking before parliament today. However, he didn’t shy away from raising the prospect that interest rates might have to go up should wage growth and inflation accelerate by more than anticipated.

Unlike his predecessor, Ueda doesn’t seem to be afraid to discuss monetary tightening and this is helping the yen to recoup some losses against the euro and pound today after hitting fresh lows.

Equities slip in wait for big tech earningsOn Wall Street, e-mini futures have started the day in the red, following the trend in Europe and Asia, after another subdued session on Monday. The S&P 500 and Dow Jones closed marginally higher but the Nasdaq fell 0.3% as some tech stocks came under pressure ahead of key earnings this week. Microsoft and Google parent Alphabet will report their results later today, along with Visa and General Electric.

Although the majority of companies that have reported so far have exceeded their earnings estimates, many stocks, particularly tech ones, have already rallied significantly this year so a lot is riding on not just the size of the beat but also on how positive or negative their guidance about the rest of the year will be.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.