Is the 5,000 milestone in sight for the S&P 500? – Stock Markets

Mega-cap stocks drive S&P 500 towards 5,000 milestone

AI and tech dominate the bull charge to unchartered territory

But how sustainable is the uptrend?

It wasn’t the best start for Wall Street in 2024 as the major indices stumbled during the first week of the new year. However, it didn’t take long for Fed rate cut expectations to take off again and revive risk appetite. More recently, the artificial intelligence (AI) mania has made a comeback, fuelling the rally even more.

As demonstrated during the pandemic, tech stocks are seen to be somewhat immune to negative shocks to the global economy. Add to that the growth potential that the integration of AI can deliver, most investors have come to the conclusion that you can’t go wrong with the Big Tech, which are best placed to tap into all of AI’s capabilities.

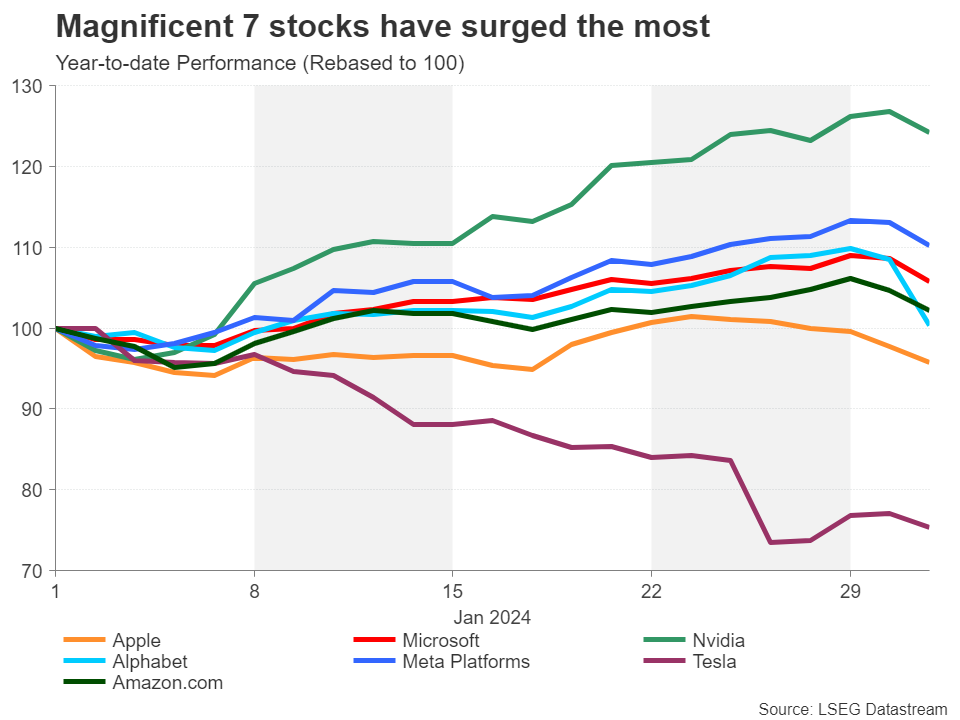

The AI craze isn’t overThose that are ahead of the AI race like Microsoft and Nvidia, have seen their shares outperform. Those deemed to not be doing enough to capitalize on the latest hype, have been lagging. Apple and Alphabet unusually fall into the latter camp, while Facebook’s parent Meta has been a surprise winner as the company has quietly been launching several AI tools such as chatbots on its platforms.

But whilst the primary drivers of this latest bullish phase have been the tech stocks belonging to the Magnificent Seven, other mega-cap stocks have also been enjoying strong gains in January.

Outside of the Big TechWithin the broader tech sector, IBM has come back into favour amid its push away from hardware and towards cloud-based services. Intel hasn’t been as fortunate as it’s failed to convince investors that it’s on the right track when it comes to keeping up with the competition despite decent earnings. AMD on the other hand has maintained optimism about its earnings prospects even though its latest offerings have yet to boost its revenue significantly.

It's not all rosyThe biggest threat, though, to unravelling all the euphoria are further potential disappointments from Apple and Google owner Alphabet. Excluding the Vision Pro headset, which isn’t a mainstream product, Apple hasn’t launched anything very exciting in years, while its highly anticipated fully autonomous Apple Car debut keeps getting pushed back. As for Alphabet, its cloud revenue growth hasn’t been as impressive as Microsoft’s or Amazon’s and the slow development of its AI-based services has frustrated investors.

Non-tech winnersThe good news for Wall Street is that there are bright spots outside of the tech arena too. Pharmaceuticals have had a strong start to the year, led by the likes of Eli Lilly and Merck, and so have telecommunication and software stocks such as Verizon and Salesforce.

This has meant that the Dow Jones Industrial Average made up mostly of ‘old economy’ stocks has been doing almost as well as tech-heavy Nasdaq 100 this year. The S&P 500 has a slight lead over both, however, and could soon be making headlines about passing the 5,000 mark for the very first time.

As S&P 500 approaches 5,000, mind the gapWith the earnings season not going entirely smoothly after the disappointing results from Tesla and Alphabet, and the Fed signalling at its January meeting that rate cuts are not imminent, reaching that milestone might have to wait.

The 50-day moving average slightly above the 4,700 level could be a convenient support area in the event of a sizeable short-term pullback. But if buyers return, the 5,000 level is within grasp and won’t require much effort to seize it.

A dangerous trend?Looking ahead, the main challenge for the S&P 500, Dow Jones and Nasdaq will be to prevent mega-caps from increasing their domination even more. In particular, the influence of the Magnificent Seven over the entire stock market is reaching alarming levels, as together, they make up almost 30% of the S&P 500.

The danger with this trend is not just the risk of the benchmark indices being hit hard should the Magnificent Seven come crashing down, but also that the more dominant they become, the more funds they will attract, leaving small caps left out in the cold.Aset Berkaitan

Berita Terkini

Penafian: Entiti XM Group menyediakan perkhidmatan pelaksanaan sahaja dan akses ke Kemudahan Dagangan Atas Talian, yang membolehkan sesorang melihat dan/atau menggunakan kandungan yang ada di dalam atau melalui laman web, tidak bertujuan untuk mengubah atau memperluas, juga tidak mengubah atau mengembangkannya. Akses dan penggunaan tersebut tertakluk kepada: (i) Terma dan Syarat; (ii) Amaran Risiko; dan Penafian Penuh. Oleh itu, kandungan sedemikian disediakan tidak lebih dari sekadar maklumat umum. Terutamanya, perlu diketahui bahawa kandungan Kemudahan Dagangan Atas Talian bukan permintaan, atau tawaran untuk melakukan transaksi dalam pasaran kewangan. Berdagang dalam mana-mana pasaran kewangan melibatkan tahap risiko yang besar terhadap modal anda.

Semua bahan yang diterbitkan di Kemudahan Dagangan Atas Talian kami bertujuan hanya untuk tujuan pendidikan/maklumat dan tidak mengandungi – dan tidak boleh dianggap mengandungi nasihat kewangan, cukai pelaburan atau dagangan dan cadangan, atau rekod harga dagangan kami, atau tawaran, atau permintaan untuk suatu transaksi dalam sebarang instrumen kewangan atau promosi kewangan yang tidak diminta kepada anda.

Sebarang kandungan pihak ketiga serta kandungan yang disediakan oleh XM, seperti pendapat, berita, penyelidikan, analisis, harga, maklumat lain atau pautan ke laman web pihak ketiga yang terdapat dalam laman web ini disediakan berdasarkan "seadanya" sebagai ulasan pasaran umum dan bukanlah nasihat pelaburan. Sesuai dengan apa-apa kandungan yang ditafsir sebagai penyelidikan pelaburan, anda mestilah ambil perhatian dan menerima bahawa kandungan tersebut tidak bertujuan dan tidak sediakan berdasarkan keperluan undang-undang yang direka untuk mempromosikan penyelidikan pelaburan bebas dan oleh itu, ia dianggap sebagai komunikasi pemasaran di bawah peraturan dan undang-undang yang berkaitan. SIla pastikan bahawa anda telah membaca dan memahami Notifikasi mengenai Penyelidikan Pelaburan Bukan Bebas dan Amaran Risiko mengenai maklumat di atas yang boleh diakses di sini.