RBNZ policy meeting: 25 or 50 bps rate cut? – Preview

- RBNZ decision could shake kiwi/dollar

- As inflation ticks lower, another rate cut is expected

- Policy meeting takes place on Wednesday at 01:00 GMT

RBNZ decision to cut rates

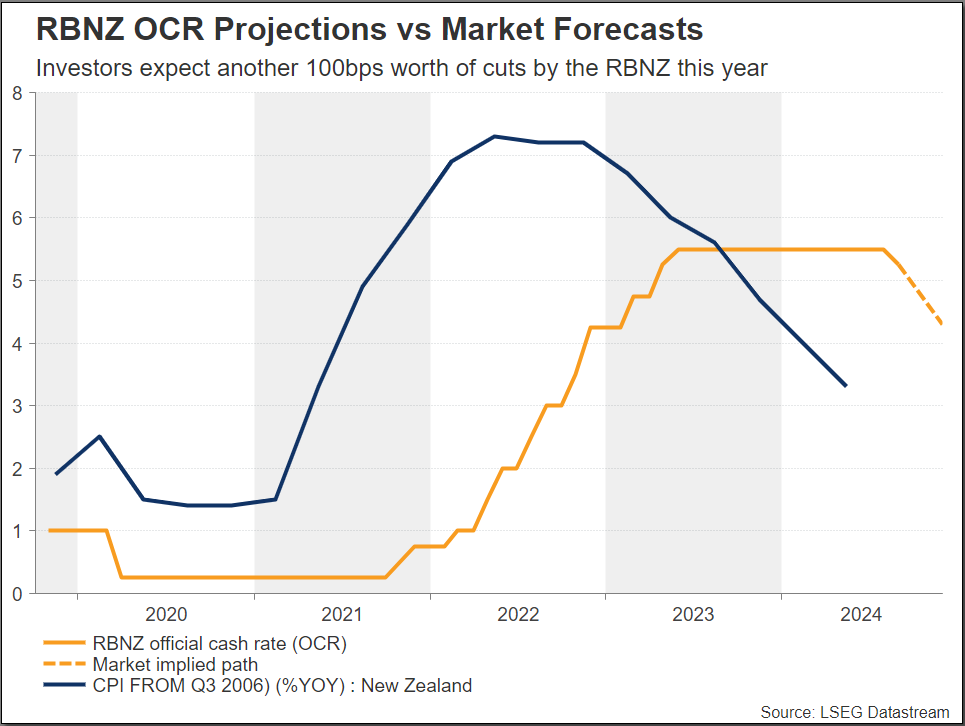

The Reserve Bank of New Zealand is poised to make another rate cut on Wednesday. The RBNZ is expected to follow the Federal Reserve with a half-point cut, as the pressure to reduce real rates at a faster tempo is being exacerbated by a sluggish activity picture and lower inflation. But while a smaller 25-bps reduction cannot be ruled out, markets may continue to favour a dovish pricing approach for an extended period, putting downward pressure on the New Zealand dollar.

Inflation slows down

The inflation rate in New Zealand has been decreasing, and the consumer price index is now approaching the RBNZ's target range of 1-3%. This decline is the result of a decrease in domestic demand pressures and a reduction in imported inflation. It is also anticipated that the inflation of services, which has remained relatively high, will decrease as economic capacity increases.

The New Zealand economy has been showing below-trend expansion in recent quarters, while domestic economic activity has clearly and broadly weakened. The global economic situation affects this slowdown since growth in developed countries stays modest/subdued. However, encouragingly for future price stability, the RBNZ notes that business inflation expectations have fallen to roughly 2% in the medium- and longer-term horizons.

The RBNZ is expected to take a more accommodative approach considering the present economic climate. The stability of inflation expectations and the degree to which price-setting behaviour adjusts to a reduced inflation environment will determine the rate of future rate reductions.

What analysts are saying

Due to the persistent weakness and rising spare capacity in the New Zealand economy, analysts are divided on the extent of the rate cut. Some analysts advocate for a decrease of 50 basis points, while others advocate for no reduction at all. Others propose a 25-basis-point reduction, which is more cautious and accounts for the potential for upside risks in non-tradable inflation. The decision made by the RBNZ will be keenly monitored for any indications related to the future course of monetary policy.

Will this policy meeting affect the kiwi/dollar?

The anticipation of a 50-bps reduction in the RBNZ will have a detrimental effect on the kiwi. Investors are likely to price in a high probability of an additional 50-bps cut for the 27 November meeting, unless there is substantial wording against further half-point reductions ahead. Markets are not entirely pricing in such a move.

In the end, a non-tradable CPI that is slightly above the consensus when it’s released on October 15 could be beneficial for hawkish repricing and provide some relief to the New Zealand dollar. However, the turbulent risk sentiment situation resulting from Middle East tensions, in addition to potential defensive prepositioning ahead of the US elections, may limit NZD’s rebound attempts. Anything less than 50 bps in the October and November meetings would probably cause a massive move to the currency. Moreover, before the US election, NZD/USD may return to approximately 0.6100.

Currently, kiwi/dollar is experiencing a bearish correction following an aggressive pullback from the 15-month peak of 0.6380 on September 30, which resulted in a loss of more than 3%.

Aset Berkaitan

Berita Terkini

Penafian: Entiti XM Group menyediakan perkhidmatan pelaksanaan sahaja dan akses ke Kemudahan Dagangan Atas Talian, yang membolehkan sesorang melihat dan/atau menggunakan kandungan yang ada di dalam atau melalui laman web, tidak bertujuan untuk mengubah atau memperluas, juga tidak mengubah atau mengembangkannya. Akses dan penggunaan tersebut tertakluk kepada: (i) Terma dan Syarat; (ii) Amaran Risiko; dan Penafian Penuh. Oleh itu, kandungan sedemikian disediakan tidak lebih dari sekadar maklumat umum. Terutamanya, perlu diketahui bahawa kandungan Kemudahan Dagangan Atas Talian bukan permintaan, atau tawaran untuk melakukan transaksi dalam pasaran kewangan. Berdagang dalam mana-mana pasaran kewangan melibatkan tahap risiko yang besar terhadap modal anda.

Semua bahan yang diterbitkan di Kemudahan Dagangan Atas Talian kami bertujuan hanya untuk tujuan pendidikan/maklumat dan tidak mengandungi – dan tidak boleh dianggap mengandungi nasihat kewangan, cukai pelaburan atau dagangan dan cadangan, atau rekod harga dagangan kami, atau tawaran, atau permintaan untuk suatu transaksi dalam sebarang instrumen kewangan atau promosi kewangan yang tidak diminta kepada anda.

Sebarang kandungan pihak ketiga serta kandungan yang disediakan oleh XM, seperti pendapat, berita, penyelidikan, analisis, harga, maklumat lain atau pautan ke laman web pihak ketiga yang terdapat dalam laman web ini disediakan berdasarkan "seadanya" sebagai ulasan pasaran umum dan bukanlah nasihat pelaburan. Sesuai dengan apa-apa kandungan yang ditafsir sebagai penyelidikan pelaburan, anda mestilah ambil perhatian dan menerima bahawa kandungan tersebut tidak bertujuan dan tidak sediakan berdasarkan keperluan undang-undang yang direka untuk mempromosikan penyelidikan pelaburan bebas dan oleh itu, ia dianggap sebagai komunikasi pemasaran di bawah peraturan dan undang-undang yang berkaitan. SIla pastikan bahawa anda telah membaca dan memahami Notifikasi mengenai Penyelidikan Pelaburan Bukan Bebas dan Amaran Risiko mengenai maklumat di atas yang boleh diakses di sini.